Medicare Liens and Wrongful Death Cases in Florida: Who Gets What?

You have a Florida wrongful death case involving your Mom in which you and your sister are survivors under the statute. The wrongful death case settles for $500,000, but there is a $250,000 Medicare lien. The reason you brought the claim was because you missed your Mom, not to pay back Medicare. So how does the gross settlement figure get divided between you and Medicare?

Bradley v. Sebelius Controls in Florida Wrongful Death Allocation Hearings

Bradley v. Sebelius, 621 F.3d 1330 (11th Circuit 2010) was a game changer in terms of allocating wrongful death proceeds. In the Bradley decision, the 11th Circuit held that the Probate Court may allocate the gross settlement in an Equitable Distribution hearing. The landmark decision holds that the survivor’s damages are separate and independent from any liens on the estate. This allows survivors of the decedent to significantly reduce Medicare’s lien through allocation of the proceeds to the survivors.

The Significance of Bradley

Because a survivor’s claim for pain and suffering is their own property, the decedent’s Medicare liens cannot attach to it. This means if the Court finds 90% of your gross settlement to be for pain and suffering, Medicare can only attach its lien to the remaining 10% of the settlement (the property of the Estate).

Procedurally, How a Motion to Allocate Wrongful Death Settlement Proceeds Occurs

As Boynton Beach wrongful death lawyers, we regularly file Motions to Allocate in the Probate Court. In our Motion, we put forth evidence that the claim was primarily for pain and suffering in missing the deceased. We then put Medicare (and any other lienholders) on notice of the hearing and serve our Motion.

In the hearing, the Probate Judge must determine the percentage of the settlement attributable to the survivors (pain and suffering damages) versus the Estate’s property (medical bills and liens). Once the Judge makes her allocation pursuant to Bradley v. Sebelius, we write a check to Medicare for the allocated amount.

A Real Life Example of an Equitable Distribution Using Bradley v. Sebelius

Let’s stick with the above example. Your Mom passes away and you settle the case for $500,000. The Medicare lien is $250,000. If our lawyers were successful in allocation 90% of the settlement proceeds to you and your sister for pain and suffering, and allocating 10% of the settlement to the Estate, the practical effect is as follows:

$450,000 to you and your sister, and

$50,000 to the Estate.

This means that Medicare’s $250,000 can only attach to the Estate’s property, which is $50,000. This effectively reduces Medicare’s lien down to 1/5th its original amount, since Medicare cannot attach liens to you and your sister’s property.

A Bradley Motion to Allocate Wrongful Death Settlement Example

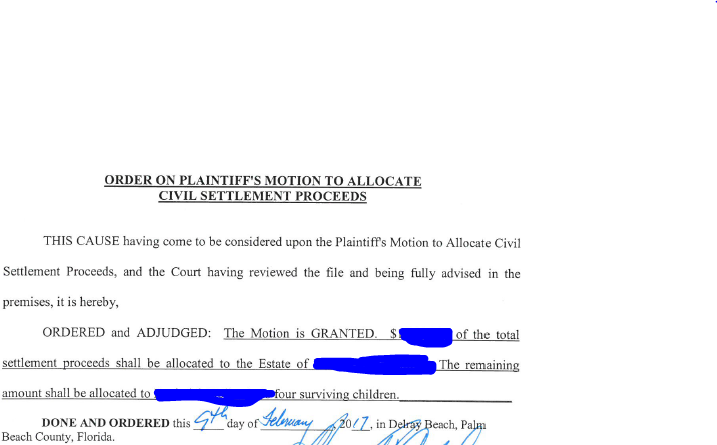

Below is a sample Bradley Motion for Equitable Distribution Order

More Questions on an Equitable Distribution Motion Using Bradley v. Sebelius?

Contact our knowledge and caring attorneys today for your free consultation.