Can I avoid paying an ALF rent bill if they neglected and injured the resident?

Quick Answer: Even if you received poor care, you probably still owe rent to the assisted living facility. However, it may be the resident, and not you, that owes the money. Further, if the bad care resulted in an injury at the ALF, you may recover much more than the rent payment via an ALF negligence lawsuit. Read a detailed legal analysis below.

Avoiding an Assisted Living Facility Rent Payment Due to Negligent Care

Assisted living facilities (ALFs) are designed to provide a safe, supervised environments for vulnerable residents that require assistance with daily activities, such as bathing, dressing, walking and medication management. These facilities are paid thousands of dollars a month in rent, but this is much more than a landlord-tenant relationship. Assisted living centers and memory care units are supposed to keep residents safe.

The sad reality is that not all assisted living facilities meet the standards of care that residents and their families expect. Oftentimes, this leads to bad outcomes, like hospitalization, injury, and sometimes, wrongful death.

When an ALF provides inadequate care, it raises an important question:

If a facility fails to deliver the promised services, supervision, and support, do residents or their families still have a financial obligation to pay the bill? The short answer is, it depends on the circumstances.

Our assisted living negligence attorneys analyze whether a family is responsible for an assisted living bill if the resident received poor care.

Honestly I wasn’t expecting much and I was skeptical going in. The team at Senior Justice proved themselves to be compassionate and respectful as well as holding the facility responsible for their actions. We received a much larger compensation than I had imagined and my brother and I are truly thankful for the folks at Senior Justice.

Michael more than exceeded my expectations and I will always be grateful for what he did to help me during a very trying time in my life.

I highly recommend the Senior Justice Law Firm, if you are searching for a professional team of attorneys who will be looking out for your best interest.

At Senior Justice Law Firm, our elder abuse attorneys specialize in handling cases involving injury and wrongful death against assisted living and nursing home facilities. If your family member was hurt or killed inside an ALF, speak with Senior Justice Law Firm today by live chatting with our office, or calling us now at 888-375-9998.

Understanding the Care Agreement

Before delving into the implications of poor care, it’s essential to understand the typical structure of care agreements in assisted living facilities. Residents or their Power of Attorney usually sign a contract that outlines the services they will receive in exchange for their fees.

This assisted living facility contract often includes provisions for personal care, assistance with activities of daily living, meals, social activities, and health monitoring. The ALF contract, commonly called a ‘Residency Agreement’, is a legal document that establishes the expectations for both parties. This document will control your obligations and whether you have to pay the facility, even if your family member was hurt or died due to facility negligence.

When residents or their families feel that the facility has not upheld its end of the agreement by providing substandard care, the first step is to review the contract in detail. Many contracts contain clauses that specify the quality of care and services that residents should expect. These clauses can be crucial in determining whether a resident is obligated to pay for services that were not rendered satisfactorily.

Possible Ways to Avoid Paying a Senior Care Facility After a Bad Outcome

Breach of Contract

If an assisted living facility fails to provide the level of care promised in the contract, it may be considered a breach of contract. In legal terms, a breach occurs when one party fails to fulfill their obligations as specified in the agreement.

If a resident or their family can demonstrate that the facility has not met its contractual obligations, they can claim there was a breach and no payment is owed.

Concerns With Claiming Breach of Assisted Living Contract

This is a tricky option. If you technically owe money to a facility but claim the facility breached its contract, in theory, you can withhold payment. However, the facility will likely sue you and send you to collections.

In order to prove your breach of contract claim, you will have to litigate against the facility. This will cost you attorneys fees and court costs which likely outweigh the $10,000 to $20,000 you owe the facility.

Ultimately, this is probably not your best option in disputing a balance owed to the facility.

Not a Financially Responsible Party

Oftentimes, assisted living facilities enter into agreements with the resident themselves. If the resident becomes injured, incapacitated, or dies, they may look to you, the adult child, for payment on the outstanding assisted living bill.

Another common scenario is the adult child of the resident signs the ALF Residency Agreement as power of attorney for the resident. Even though it is the adult child’s signature on the agreement, it is exclusively on behalf of the resident. The adult child never stipulates to being financially responsible for any outstanding balance owed to the facility.

In these two scenarios above, is an adult child responsible for paying the outstanding balance owed by their parent to an assisted living facility? Probably not.

Concerns With Claiming Not a Financially Responsible Party

This defense is entirely contract based, so you would have to read the Residency Agreement to see if you financially guaranteed the debt of your parent. However, without that guarantee, you are unlikely to owe a balance to the assisted living facility.

In theory, your parent still owes the balance on the ALF bill. However, if they are incapacitated, uncollectable, or deceased, it may not bother you if that debt remains unpaid.

ALF Negligence as a Defense to Not Paying Room and Board Rent

If your loved one was wrongfully injured inside a Memory Care or ALF, you likely have a viable claim based on assisted living negligence.

This does not have any legal connection to an outstanding debt for rent, however, when an injury case is pursued, the outstanding rent payments inevitably get discussed.

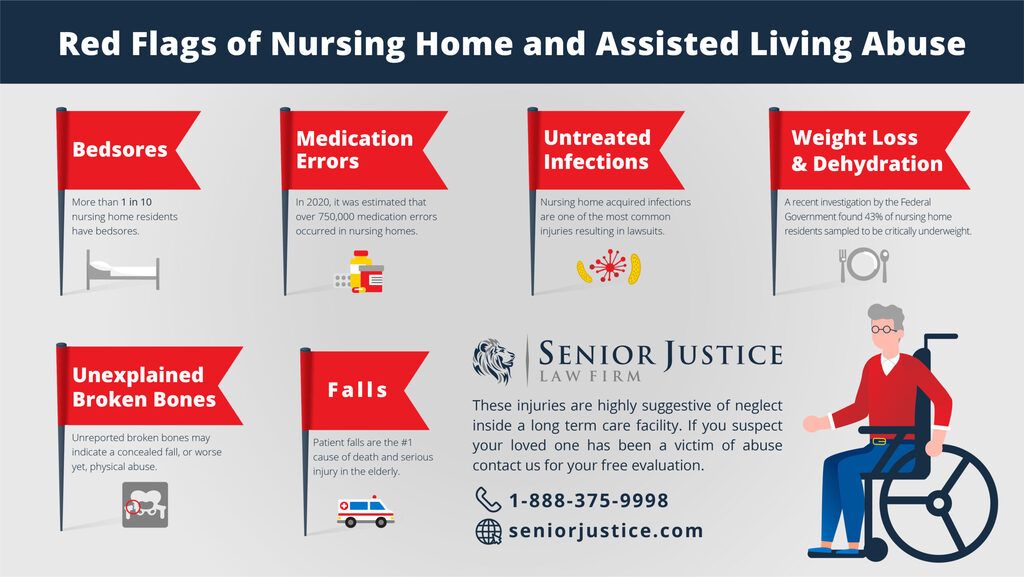

Be on the lookout for these red flag injuries which correlated strongly with assisted facility negligence.

Common injuries our law firm handles arising out of ALF negligence include:

- Facility falls resulting in fractures

- Medication overdose or errors

- Elopement/Escaping from the facility

- Pressure injuries and Bedsores

- Assaults and attacks on residents

- Sexual abuse

- Wrongful death

Failing to keep a resident safe is a form of ALF neglect. If the resident suffers serious injury as a result, the facility may be held liable.

Legal claims of negligence focus on whether the facility acted in a way that a reasonable person in a similar situation should act. If a facility provides poor care resulting in injury, it may open itself up to legal action and potential damages.

Concerns With Claiming No Rent Owed Due to Facility Negligence

If a facility fails to assist and supervise a resident in need, and then that resident gets hurt or dies, there is likely a case for the injury sustained. This does not, however, excuse the rent owed to the facility.

Practically speaking, when a family brings a lawsuit over injuries, the recovery usually outweighs whatever balance is owed to the facility.

For example, if a fall risk resident falls and breaks their hip at a Memory Care, this does not excuse the $8,000 monthly rent owed for the month that the resident lived there. However, if the family sues the ALF for the fall/hip fracture and recovers $75,000, this recovery subsumes the debt owed for rent in multiples.

Justifying Non Payment to a Negligent Nursing Home or Assisted Living Facility

It may feel wrong to pay a facility if they neglect and injure your loved one. When resident families are faced with the decision to write a check to a facility that harmed their loved one, they must balance the impulse to ignore the bill with the business decision of avoiding a legal headache.

On one hand, paying for services that were not delivered can feel unjust and reinforce poor practices within the facility. On the other hand, refusing to pay may result in collections attempts.

Conclusion and A Possible Solution

The question of whether residents of assisted living facilities are obligated to pay for services rendered inadequately is complex, encompassing legal, ethical, and practical considerations. While contracts provide a framework for care agreements, the failure to meet these obligations can lead to claims of breach of contract and negligence.

You may technically be right that a facility breached its contractual duty, but is the juice worth the squeeze? It might cost you $50,000 in attorneys fees and court costs to invalidate an outstanding rent balance of $10,000.

A better option may be to investigate an injury lawsuit against the negligent facility. If your family member suffered injury, hospitalization, or wrongful death due to the poor care at the facility, speak with our narrowly focused elder abuse attorneys at Senior Justice Law Firm.

Most of our assisted living facility injury cases resolve in excess of $50,000. This means the recovery far exceeds what you owe in rent.

Our attorneys cannot help you avoid a contract for breach on the facility’s part. We cannot get you out of paying outstanding rent to an ALF. All we do is file injury and wrongful death claims against negligent healthcare facilities.

However, if your family member was hurt while a resident at the assisted living facility, contact our skilled and compassionate attorneys today for a free injury case consultation. We require nothing out of pocket from you and we only get paid if we make a recovery on your injury case. If successful, we take a percentage of the recovery as our attorneys fees.

Suing the facility for injury might deliver your family the justice and peace of mind you seek, while avoiding the legal ramifications of not paying an outstanding ALF bill.