Who Really Owns this Nursing Home? And Why Does it Matter?

Currently, most privately owned nursing homes employ a complex web of LLC’s to mask the true identity of the facility’s ownership. However, the Centers for Medicare and Medicaid Services announced that its new attempts to increase transparency in the nursing home arena will now include publicizing ownership changes for facilities.

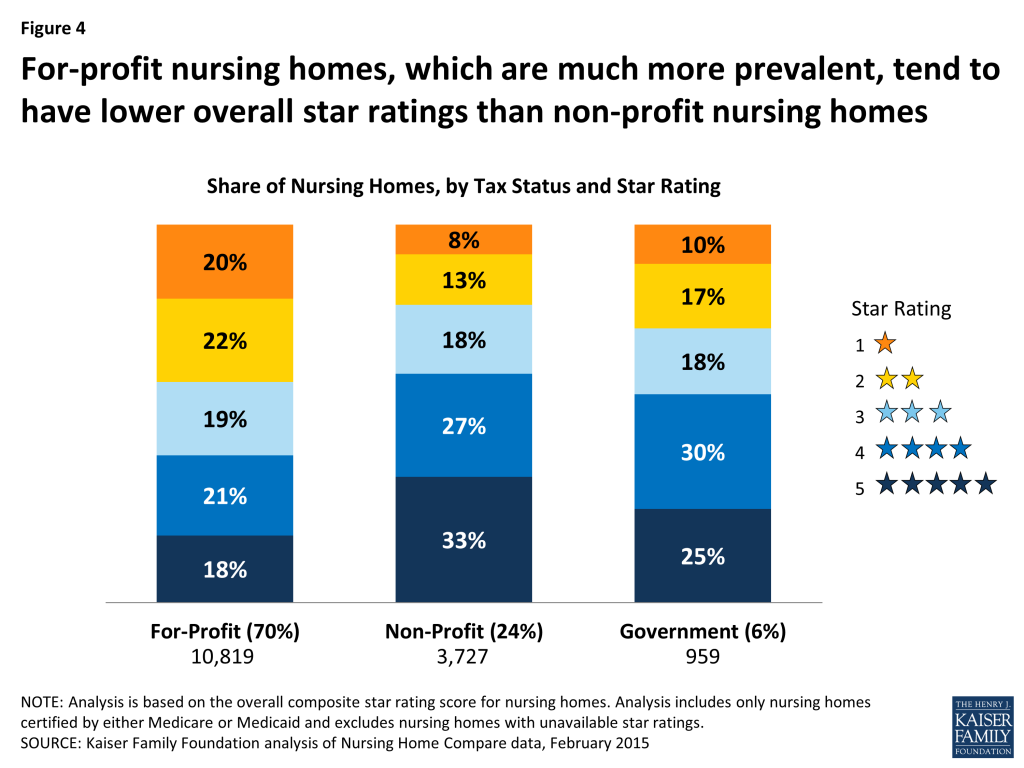

This change comes as part of the White House’s broader attempts to improve our understanding of what contributes to success and quality in nursing homes. Unsurprisingly, suspicions that for-profit nursing home owners put their profits ahead of resident safety are confirmed with this data.

Why Transparency of Nursing Home Ownership Matters: Bye Bye REITs; Hello Shady Private Owners

Nursing homes, it seems, have changed ownership almost three times as often as hospitals between 2016 and 2021, and current data indicate that more than 60% of nursing homes are purchased by a single owner. This may seem like a great idea. A single owner/operator would, in theory, keep management focused on a singular project instead of spreading facility administration (and bureaucracy) across a distant corporate boardroom.

However, statistics show that the opposite is true. Some of the country’s worst run facilities are owned by convoluted corporate webs of notorious “nursing home mafia bosses” that extract every cent possible from the facility, dooming the staff to fail.

Private equity and REIT owners are becoming more sparse with time. Hedge funds and real estate investors are moving out of the skilled nursing space and, in their place, comes the shady nursing home mogul.

Although REITs were certainly not the best of owners, real estate investors had a vested economic interest in ensuring that the nursing home properties they own are valuable. With this comes the desire to keep facilities functioning smoothly, in good repair, and with favorable public opinion. In exchange, the overall value of the property when the REIT would inevitably try to sell the nursing home property would remain high.

Private Nursing Home Owners Leverage a “Debt Overload” Business Model

In contrast to REITs, private owners are not motivated by keeping the property and underlying facility highly rated and valuable. Instead, the rise of the “owner/operator” follows a trend of allowing individuals to borrow significant amounts of debt with low cost capital. In other words, nursing homes become investments in and of themselves that are used to leverage financial power, through institutional lending, for greater gain. Large nursing homes are gobbled up and repurposed as debt carrying vehicles. The owner then contracts out the operation of the facility, which has to pay a hefty rent to cover the overbearing debt load. This leaves the underlying operator of the facility an impossible task: cover the extraordinary amount of debt by packing the facility and slashing staff.

What happens in response? Owner/operators attempt to fill the facility with as many paying beds as possible while cutting staff levels. This results in awful care, and inevitably, preventable injuries like bed sores, resident falls, and wrongful death.

Understaffed Nursing Homes Kill Residents

It is well documented by researchers that understaffed nursing homes cause far more injuries and wrongful death. Simply put, when there are not enough nurses and CNA’s around to supervise vulnerable residents, terrible things happen.

When private investors assume control of a facility, overleverage the nursing home with debt, and squeeze the facility operator with high rent, the result is foreseeable. The operator is forced to maximize the census of the facility with “a head in every bed” while slashing the staff ratio to make the facility more profitable.

Skilled Nursing Facilities Owned by Private Equity and REITs Perform Below Not for Profit Facilities

Nursing homes owned by REITs and by private owners can be lumped together into a larger category of ‘for profit’ nursing homes. Even though REIT’s tend to provide better care than privately owned facilities, both pale in comparison to true non-profit facilities. Staffing levels across the board are lower at for-profit nursing homes when compared to non-profit facilities.

It should come as no surprise that overpopulation of a nursing facility leads to reduced quality of life and lackluster health outcomes, as staff are stretched thin and forced to spend only minutes at a time with each resident. The best rated facilities—and those with the fewest health inspection citations—remain, on average, those with fewer beds and a robust, rested staff who are not hurried from room to room.

The White House’s efforts to make such information transparent have placed us on a valuable path to effect change. With this data, drawing a stronger correlation between privately owned and operate facilities and their resultant health outcomes becomes possible—and with it, adjustments can be made to disincentivize nursing homes as a form of real estate profit at the expense of the residents who live there.

Exploitation of human life should never be the means of making profit, but this is exactly what is happening in nursing homes across the country. The curtailing of HUD loans for owner/operators and a greater incentive for private equity entities to purchase facilities could lead to a dramatic increase in quality of care. We must also remain vigilant to monitor the health outcomes across a wide range of facilities so that we can protect families across America from abuse and neglect.

If your loved one was wrongfully injured or killed inside a facility, speak with our nursing home attorneys today at 888-375-9998. We can help unpack the complicated corporate structure of the facility and determine who really owns the underlying facility.